Why CRM License Calculations Go Wrong (And How to Estimate Accurately)

Learn why CRM license calculations often exceed budgets by 20-40%. Understand read-only users, API accounts, minimum seat requirements, and contract clauses that impact total costs.

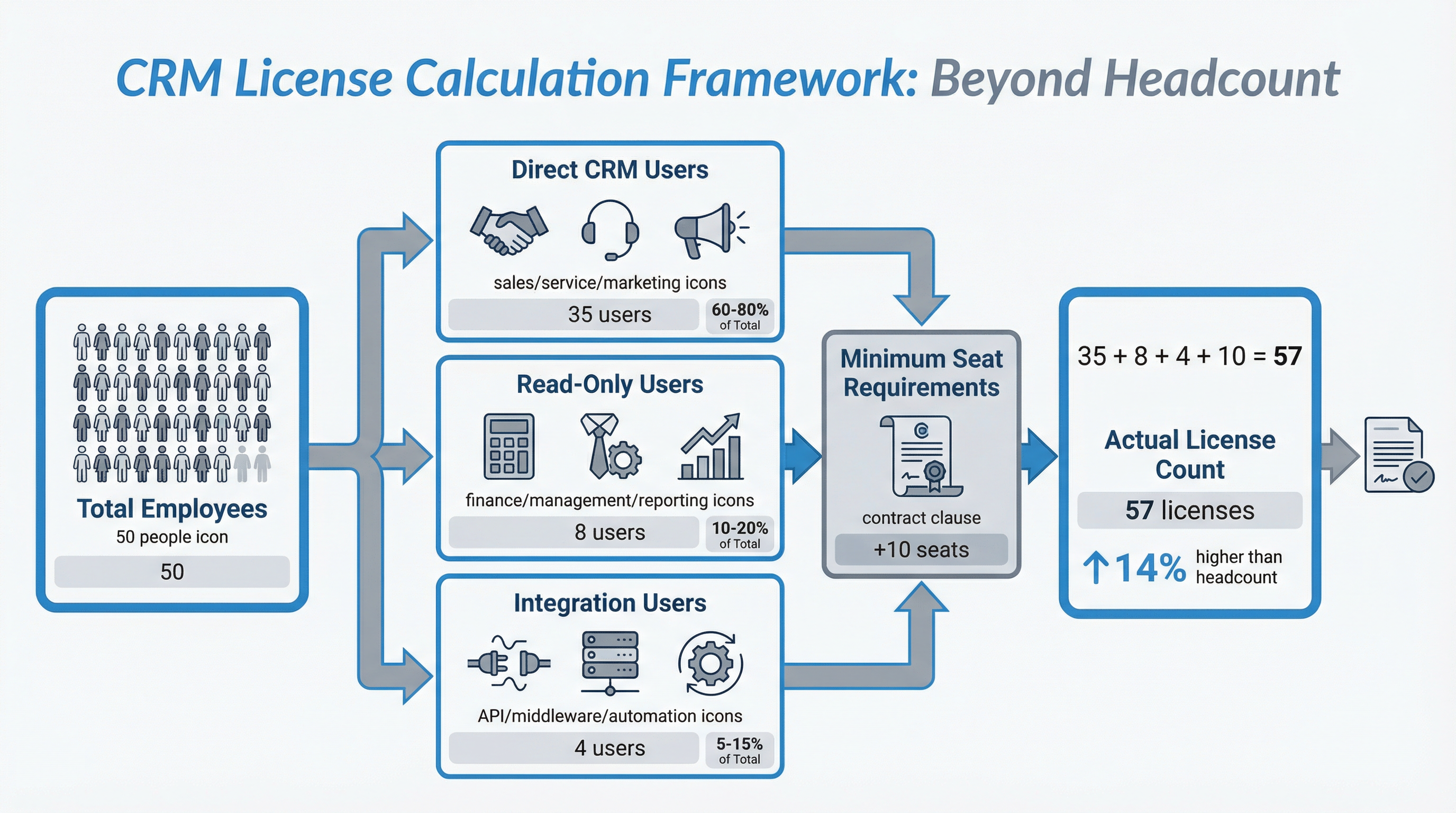

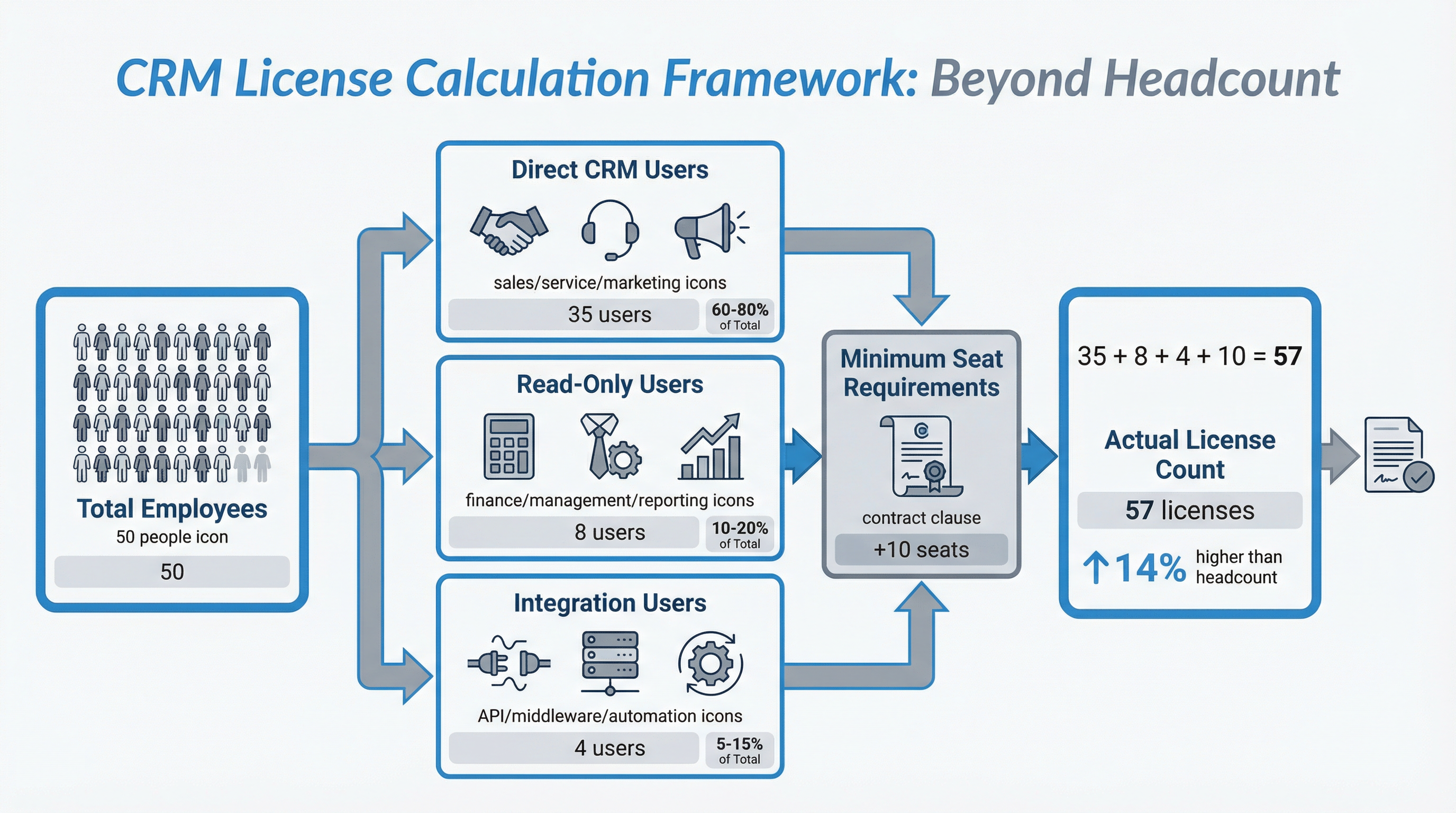

When a 50-person company decides to implement a CRM system, the IT director typically estimates they need 50 licenses. This seems logical—one license per employee. Six months later, the finance team discovers they're paying for 72 licenses: 50 for the sales and service teams, 8 for read-only access (finance, management, reporting), 4 for integration users (marketing automation, support desk connectors), and 10 additional seats to meet the vendor's minimum contract requirement. The actual cost is 44% higher than the initial budget.

This scenario repeats across organizations of every size because CRM license calculation is fundamentally misunderstood. The question isn't "how many people work here" but rather "who needs what level of access, and what does the contract actually require." The gap between these two questions explains why CRM implementations consistently exceed their projected costs.

## The Flawed Assumption: Headcount Equals License Count

Most organizations begin CRM procurement by counting employees who will "use" the system. Sales representatives need full access to manage deals, customer service agents need to log support tickets, and marketing teams need to track campaign performance. This headcount becomes the basis for license estimation.

The problem emerges when organizations fail to account for three categories of users who don't fit the traditional "CRM user" profile but still consume licenses under most vendor agreements. These hidden users create the gap between estimated and actual licensing costs.

**Read-only users** represent the first category. Finance teams need to review revenue forecasts. Executive leadership requires dashboards showing pipeline health and conversion rates. Operations teams monitor service ticket volumes and resolution times. None of these users create or modify CRM records, yet most CRM platforms charge for read-only access at rates ranging from 50% to 100% of full-user pricing. A company with 40 active CRM users might discover they need 12 additional read-only licenses for stakeholders across finance, operations, and leadership—increasing the license count by 30%.

**Integration users** create the second category of hidden costs. Modern business operations rely on connected systems: marketing automation platforms pull lead data from the CRM, customer support tools sync ticket information, billing systems reference customer records, and analytics platforms aggregate CRM data for reporting. Each of these integrations often requires a dedicated "API user" or "integration user" license. Organizations routinely underestimate this requirement, assuming integrations happen "in the background" without consuming licenses. In practice, a mid-sized company with five integrated systems might need five additional API user licenses, each costing $30-50 per month.

**Minimum seat commitments** represent the third category, though this isn't technically a "hidden user" but rather a contract structure that forces organizations to purchase more licenses than they need. Many CRM vendors impose minimum seat requirements—typically 10, 25, or 50 licenses depending on the pricing tier. A 12-person startup that needs 8 CRM licenses discovers their contract requires a minimum of 10 seats, forcing them to pay for 2 unused licenses indefinitely. This might seem like a small overage, but it represents 25% waste on an ongoing subscription.

## Role-Based Licensing Adds Another Layer of Complexity

Beyond the challenge of counting all users who need access, organizations must navigate role-based licensing structures that charge different rates depending on what users can do within the system. This pricing model appears straightforward in vendor materials—sales users at one price, service users at another, marketing users at a third—but it creates estimation challenges when real-world roles don't align neatly with vendor-defined categories.

A sales development representative (SDR) who qualifies leads but doesn't close deals might not need a full "Sales Professional" license at $80 per month. A "Sales Essentials" license at $50 per month might suffice. However, if that SDR occasionally needs to create custom reports or access advanced pipeline analytics—features locked behind the Professional tier—the organization faces a choice: upgrade the SDR to Professional (increasing costs by 60%) or restrict their access to essential features (reducing productivity).

This same tension appears across every department. Customer service agents need basic ticket management, but if they occasionally need to view a customer's full purchase history or sales pipeline—data that lives in the "Sales" module—they might require a more expensive "Service Professional" license instead of "Service Essentials." Marketing coordinators need to track campaign performance, but if they need to create custom audience segments based on CRM data, they might need to upgrade from "Marketing Starter" to "Marketing Professional."

The financial impact compounds quickly. An organization that estimates 30 users at $50 per month ($1,500 monthly) discovers that 10 of those users need Professional-tier access at $80 per month, while the remaining 20 can use Essentials at $50 per month. The actual cost becomes (10 × $80) + (20 × $50) = $1,800 per month—a 20% increase that wasn't captured in the initial estimation.

Role-based licensing also creates ongoing administrative overhead. As employees change roles or responsibilities expand, license assignments must be reviewed and potentially upgraded. A customer service agent promoted to account manager needs their license changed from "Service" to "Sales." A marketing coordinator who takes on sales enablement responsibilities needs access to both Marketing and Sales modules. Each change triggers a pricing adjustment, and organizations that don't actively manage these transitions end up paying for higher-tier licenses than necessary—or worse, restricting employee access to tools they need to perform their jobs effectively.

## The Contract Clauses That Inflate Costs

CRM vendor contracts contain clauses that directly impact license counts but rarely receive attention during procurement. These terms don't appear in pricing calculators or sales presentations, yet they determine the actual cost of CRM ownership.

**Annual true-up requirements** force organizations to reconcile their licensed user count with actual usage at the end of each contract year. If the CRM system logs 55 unique users but the contract covers only 50 licenses, the organization must either pay retroactive fees for the 5 additional users (often at a premium rate) or commit to 55 licenses for the following year. This creates a ratchet effect where license counts only move upward, never downward, because vendors rarely allow mid-contract reductions.

**Minimum commitment periods** lock organizations into license counts for 12, 24, or 36 months. A company that scales down from 60 employees to 45 employees during an economic downturn still pays for 60 CRM licenses until the contract renewal date. The inability to reduce licenses mid-contract means organizations carry "ghost licenses" for departed employees or restructured teams, paying for access that no one uses.

**Inactive user policies** vary dramatically across vendors and directly affect whether organizations can reallocate licenses from inactive users to new hires. Some CRM platforms allow license reassignment within 30 days of a user becoming inactive. Others require a 90-day waiting period. A few vendors don't allow reassignment at all—once a license is assigned to a specific user, it remains tied to that user for the duration of the contract, even if they leave the company. Organizations that don't understand these policies end up purchasing additional licenses for new hires while paying for licenses assigned to former employees.

**Overage penalties** apply when organizations exceed their contracted license count before the annual true-up. Some vendors charge 150-200% of the standard per-user rate for overage users, creating a significant financial penalty for underestimating license needs. This punitive pricing structure incentivizes organizations to over-purchase licenses "just in case," leading to the opposite problem: paying for unused capacity to avoid overage fees.

These contract terms interact in ways that make accurate license estimation nearly impossible without understanding the full cost structure. An organization might correctly estimate they need 50 licenses today, but if they anticipate hiring 10 additional employees over the next 12 months, they face a choice: purchase 60 licenses upfront (paying for 10 unused licenses for several months) or purchase 50 licenses and risk overage penalties when they hire the additional staff.

## How to Estimate License Needs Accurately

Accurate CRM license estimation requires a different approach than simple headcount calculations. Organizations need to map access requirements across the entire company, not just the departments that will "use" the CRM daily.

Start by identifying every role that needs to view, create, or modify CRM data, regardless of how frequently they access the system. Sales representatives obviously need full access, but so do sales operations analysts who maintain data quality, sales enablement teams who create content based on CRM insights, and revenue operations managers who build forecasting models. Each of these roles consumes a license, even if they only log into the CRM once per week.

Next, catalog read-only access requirements across finance, operations, and leadership. Finance teams need to reconcile CRM revenue data with accounting systems. Operations teams monitor service metrics. Executives review pipeline dashboards. These stakeholders don't need to create or edit records, but they need visibility into CRM data. Determine whether the CRM vendor charges for read-only access and at what rate—some vendors offer discounted read-only licenses, while others charge full price.

Then, audit integration requirements. List every system that needs to exchange data with the CRM: marketing automation, customer support, billing, analytics, and any custom applications. Determine whether each integration requires a dedicated API user license or whether the vendor allows unlimited API access under a different pricing model. Some CRM platforms charge per API call rather than per integration user, which can be more cost-effective for high-volume integrations but creates unpredictable costs.

Finally, review the vendor's contract terms for minimum seat requirements, annual true-up policies, overage penalties, and mid-contract adjustment rules. These clauses determine whether your initial license estimate will hold or whether contract mechanics will force you to purchase additional licenses regardless of actual usage.

This process typically reveals that the true license count sits 20-40% higher than the initial headcount-based estimate. A company with 50 employees might discover they need 65-70 licenses when accounting for read-only users, integration accounts, and minimum seat requirements. This gap explains why CRM implementations consistently exceed their budgeted costs—not because vendors are deceptive, but because organizations underestimate the full scope of access requirements.

*This framework illustrates how CRM license requirements extend beyond simple headcount to include read-only users, integration accounts, and contract minimums—typically increasing the actual license count by 14-40% above initial estimates.*

## Balancing Over-Purchasing Against Undercapacity Risk

Once organizations understand their true license requirements, they face a strategic decision: purchase exactly the number of licenses needed today, or build in buffer capacity to accommodate growth and avoid overage penalties.

Purchasing the exact number of licenses minimizes immediate costs but creates operational friction. Every new hire requires a license procurement process, which can take days or weeks depending on the vendor's provisioning workflow. If the organization hits its license cap, new employees can't access the CRM until additional licenses are purchased, creating productivity delays. This approach works for organizations with stable headcount and predictable growth, but it introduces risk for companies experiencing rapid expansion.

Building buffer capacity—purchasing 10-15% more licenses than currently needed—eliminates provisioning delays and provides flexibility for seasonal hiring, contractor access, or unexpected growth. However, this approach increases costs immediately and requires discipline to avoid treating buffer licenses as "free" capacity. Organizations that purchase 60 licenses for 50 users often discover that all 60 licenses get assigned within months, not because they hired 10 new employees, but because departments expanded access to roles that didn't originally need CRM access.

The optimal approach depends on the organization's growth trajectory and the vendor's contract flexibility. Companies experiencing rapid growth (20%+ annual headcount expansion) benefit from buffer capacity because the cost of unused licenses is lower than the operational friction of constant license procurement. Companies with stable headcount should purchase closer to their exact needs and negotiate contract terms that allow quarterly license adjustments rather than annual true-ups.

Contract negotiation becomes critical here. Organizations should push for monthly or quarterly true-up periods rather than annual reconciliation, allowing them to adjust license counts as needs change. They should negotiate overage policies that charge standard rates rather than premium penalties, removing the financial risk of temporarily exceeding licensed capacity. They should clarify inactive user policies to ensure licenses can be reallocated quickly when employees leave or change roles.

These contract terms have more impact on total cost of ownership than the per-user price. A CRM that costs $60 per user per month with flexible quarterly adjustments and no overage penalties often proves less expensive than a CRM that costs $50 per user per month with annual true-ups and 150% overage charges, because the contract flexibility prevents the organization from carrying unused licenses or paying penalty rates.

## Why This Matters for Long-Term CRM Success

License calculation errors don't just inflate costs—they create organizational friction that undermines CRM adoption and long-term success. When finance teams discover that CRM costs are 40% higher than budgeted, they pressure IT to reduce licenses, leading to access restrictions that frustrate users. When new hires can't access the CRM for two weeks because the organization hit its license cap, they develop workarounds using spreadsheets and email, bypassing the CRM entirely. When read-only users are denied access due to cost concerns, they stop trusting CRM data and revert to requesting manual reports from sales teams.

These operational problems compound over time. Sales representatives who can't get timely support from operations teams because those teams lack CRM access become less productive. Marketing teams that can't access CRM data to measure campaign effectiveness make suboptimal decisions. Customer service agents who can't view a customer's full interaction history provide inconsistent support. The cost of these inefficiencies far exceeds the cost of purchasing the correct number of licenses upfront.

Accurate license estimation isn't about minimizing costs—it's about ensuring that everyone who needs access to CRM data can get it without artificial restrictions or procurement delays. Organizations that treat license planning as a strategic exercise rather than a simple headcount calculation set themselves up for successful CRM adoption, because they remove the access barriers that cause users to abandon the system.

This is why understanding the full cost structure—beyond the advertised per-user price—is critical when evaluating CRM options. The per-user rate matters less than the total cost of providing appropriate access to everyone who needs it, and that total cost depends on contract terms, role-based pricing, and hidden user categories that don't appear in initial estimates.