Why CRM Tier Upgrades Happen Faster Than You Budgeted For

Organizations budget CRM tiers based on current needs, but tier limits are velocity traps triggered by growth rate. Learn why measuring position without velocity leads to unexpected upgrade costs.

Most organizations approach CRM tier selection the same way they'd choose a parking space—find one that fits right now, assume it'll work for a while, and deal with constraints when they arise. This static mindset creates a predictable failure pattern: teams select tiers based on current feature needs and per-seat costs, then find themselves forced into unplanned upgrades six to nine months later, discovering the true cost is forty to sixty percent higher than originally budgeted.

The core miscalculation isn't about features or pricing transparency. It's about treating tier limits as fixed thresholds when they're actually velocity traps. A tier that "fits" your current team of twenty users with five thousand contacts isn't evaluated correctly by asking "do we need these features today?" The right question is "how many months until our growth rate pushes us past this tier's ceiling?" Organizations that skip this calculation consistently underestimate how quickly their operational momentum will collide with tier constraints.

## The Measurement Gap That Triggers Surprise Upgrades

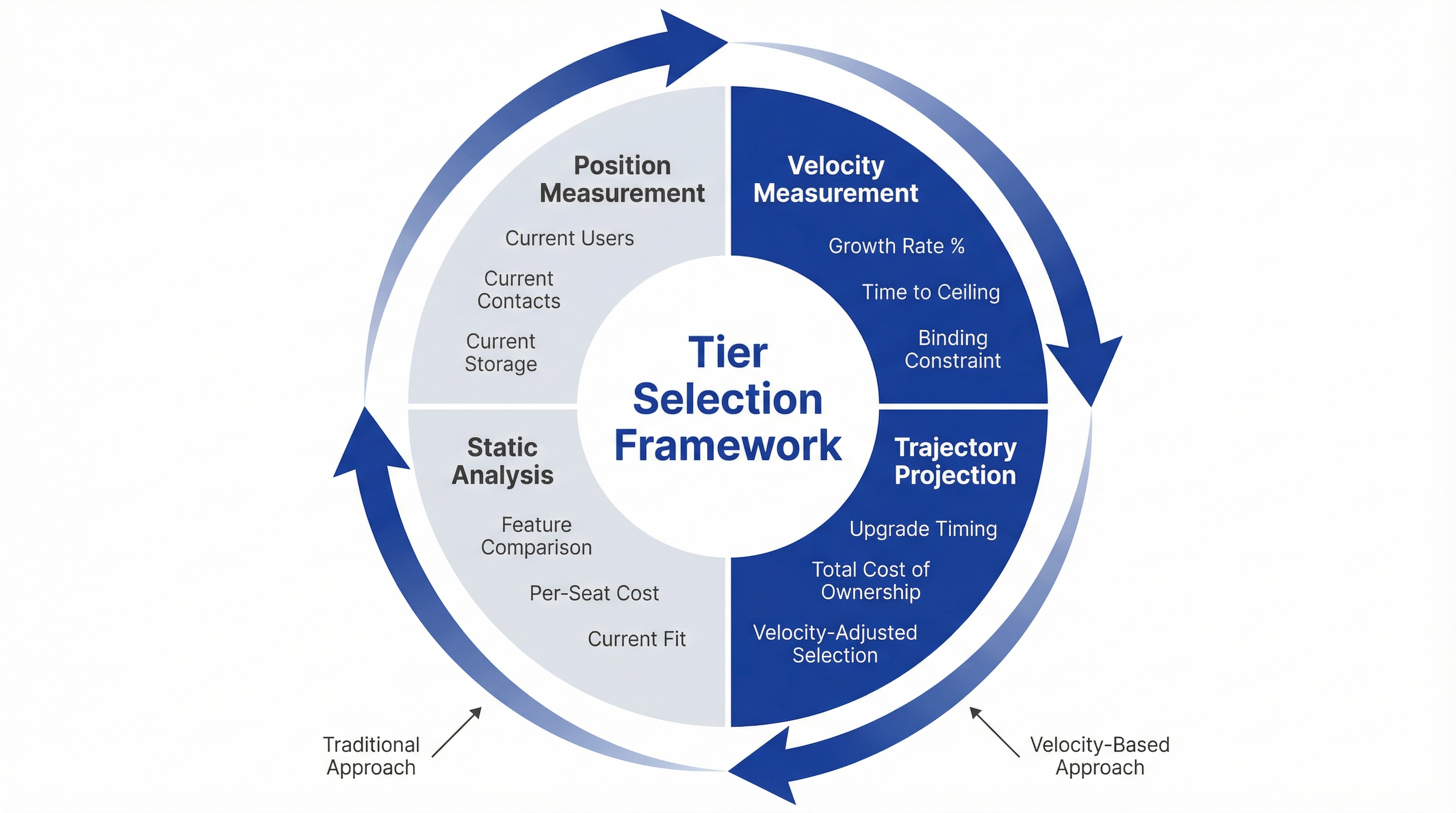

When procurement teams evaluate CRM pricing, they build comparison spreadsheets focused on observable metrics: per-seat monthly cost, feature availability across tiers, implementation fees, and competitor pricing. These are position measurements—they tell you where you are right now. What's systematically missing is velocity measurement: how fast you're moving toward each tier's constraint boundaries.

Consider a mid-market company selecting between a CRM's Professional tier (up to ten thousand contacts, fifty workflows, ten gigabytes storage) and its Enterprise tier (unlimited contacts, unlimited workflows, one hundred gigabytes storage). The Professional tier costs forty dollars per seat monthly; Enterprise costs seventy-five dollars per seat. With a current team of fifteen users and three thousand contacts, the Professional tier appears to offer comfortable headroom. The annual cost difference—six thousand three hundred dollars versus thirteen thousand five hundred dollars—makes Professional the obvious choice.

This analysis treats tier limits as static containers. It asks "do we fit?" without asking "how long until we don't?" If this company adds two hundred contacts monthly, creates two new workflows quarterly, and uploads five hundred megabytes of documents per month, they'll hit the contact limit in thirty-five months, the workflow limit in twenty-one months, and the storage limit in twenty months. The binding constraint—workflows—will force an upgrade in less than two years, well before the three-to-five-year planning horizon most organizations use for software investments.

The upgrade itself carries hidden costs beyond the per-seat price increase. Mid-cycle tier transitions require administrative time to evaluate new feature sets, training sessions for capabilities that weren't available in the lower tier, workflow reconfiguration to accommodate different automation limits, and opportunity cost when teams hit limits before the upgrade is processed. Research on SaaS pricing transitions shows that organizations experience a twenty-five percent longer sales cycle when tier upgrades involve pricing discussions, and thirty percent of customers switch plans within sixty days of initial purchase—a strong signal that tier selection was based on incomplete velocity analysis.

## Why Growth Trajectories Deceive Tier Planners

The deception isn't that organizations ignore growth entirely. Most procurement processes include growth assumptions: "we'll add five sales reps this year," "we're targeting twenty percent revenue growth," "we expect to expand into two new regions." The failure occurs in translating these business growth projections into tier constraint velocity.

CRM tier limits operate across multiple dimensions simultaneously: user seats, contact records, storage capacity, workflow automations, API calls, email sends, custom fields, and report generation. Each dimension has its own velocity, and they rarely move in lockstep. A company might add users linearly (two per quarter) while contact growth accelerates exponentially (doubling every six months as marketing campaigns scale). Workflow complexity might spike suddenly when a new product line launches, while storage accumulates steadily as document attachments pile up.

Tier selection based on aggregate "we're growing twenty percent annually" assumptions fails to capture these dimensional mismatches. A tier chosen to accommodate twenty percent user growth might hit its workflow limit at twelve months if automation complexity grows at forty percent annually. The binding constraint—whichever limit is reached first—determines when the upgrade becomes unavoidable, regardless of headroom in other dimensions.

This multi-dimensional complexity explains why organizations consistently underestimate upgrade timing. A financial services firm implementing a CRM might project conservative user growth (financial advisors are added slowly, with extensive vetting) and choose a tier sized for twenty-five users. But if each advisor manages two hundred fifty client relationships, and the firm's client acquisition strategy targets fifteen percent annual growth, contact database velocity far outpaces user velocity. The tier's contact limit becomes the binding constraint, forcing an upgrade driven by client growth rather than team expansion—a velocity the original tier analysis never measured.

The psychological trap deepens because tier limits often include "unlimited" designations that mask soft constraints. A tier advertised as having "unlimited contacts" might have undisclosed API rate limits that effectively cap bulk import operations at five thousand records daily. A tier with "unlimited workflows" might have execution time limits that prevent complex multi-step automations from completing. These soft constraints don't appear in tier comparison charts, so organizations don't measure velocity against them until operational friction surfaces.

## The Hidden Cost Structure of Mid-Cycle Tier Transitions

When an organization hits a tier ceiling and initiates an upgrade, the visible cost is the per-seat price increase multiplied by the number of users. For a twenty-person team moving from a forty-dollar to a seventy-five-dollar tier, that's an additional eight hundred forty dollars monthly, or ten thousand eighty dollars annually. This sticker shock is what procurement teams remember and what triggers retrospective regret about initial tier selection.

The sticker price, however, represents only forty to fifty percent of the true transition cost. The remainder accumulates across operational disruption, administrative overhead, and opportunity cost during the transition window.

Administrative overhead begins with the upgrade decision process itself. When a team hits a tier limit—workflow automation fails because the monthly execution quota is exhausted, or a bulk contact import is rejected because storage capacity is full—someone must diagnose the constraint, evaluate upgrade options, obtain budget approval, and coordinate the transition. For organizations with annual budget cycles, an unplanned mid-year upgrade requires exception requests, vendor negotiations, and contract amendments. Research on enterprise software procurement shows these processes consume an average of fifteen to twenty hours of internal time across IT, finance, and operational stakeholders. At a blended hourly cost of seventy-five dollars, that's eleven hundred to fifteen hundred dollars in internal labor before the upgrade is even executed.

Training costs emerge because higher tiers typically include features that weren't available in the lower tier. A team upgrading from Professional to Enterprise might suddenly have access to advanced analytics, territory management, or custom object creation. These capabilities require training sessions, documentation updates, and workflow redesigns to capture their value. Organizations that skip this training—treating the upgrade as purely a limit increase—leave value on the table, effectively paying for features they don't use because they weren't part of the original implementation plan.

Workflow reconfiguration costs arise when tier limits shaped how processes were originally designed. A team constrained to fifty workflows in their initial tier might have consolidated multiple processes into single workflows to stay within limits, creating complex, brittle automations. Upgrading to unlimited workflows doesn't automatically untangle these workarounds; someone must refactor the workflows to match the original process design intent. This refactoring work—often deferred because "the workflows are already built"—represents technical debt that accumulates until system performance or maintainability forces a reckoning.

Opportunity cost during the transition window is the most difficult to quantify but often the most significant. When a team hits a tier limit, operations don't pause while the upgrade is processed. Sales teams can't add new leads if the contact limit is reached. Marketing campaigns can't execute if email send quotas are exhausted. Support teams can't create new automation if workflow limits are hit. The revenue impact of these operational stalls—measured in delayed deals, missed campaign windows, or degraded customer experience—can dwarf the direct cost of the tier upgrade itself.

A SaaS company analyzing their CRM tier transitions found that teams hitting contact limits experienced an average of twelve days between limit detection and upgrade completion. During this window, lead capture forms were disabled to prevent exceeding the limit, resulting in an estimated four hundred seventy lost leads based on typical daily inbound volume. At their twenty percent lead-to-customer conversion rate and eight thousand dollar average customer lifetime value, those lost leads represented potential revenue of seven hundred fifty-two thousand dollars—seventy-five times the annual cost of the tier upgrade that would have prevented the constraint.

## How Tier Complexity Compounds Decision Friction

The tier ceiling problem is exacerbated by how CRM vendors structure their pricing. Research across five hundred twelve SaaS companies found that those offering three pricing tiers had thirty percent higher average revenue per user than those with four or more tiers, and companies with three-tier structures showed conversion rates approximately forty percent higher than those with five or more tiers. Yet many CRM platforms offer five, six, or even seven distinct tiers, each with subtle feature differences designed to capture specific market segments.

This tier proliferation creates a secondary decision trap: organizations spend extensive time evaluating tier differences during initial selection, then discover they evaluated the wrong variables. A team might invest hours comparing workflow limits across tiers (fifty versus one hundred versus unlimited) while overlooking storage velocity or API rate limits. The cognitive load of comparing features across multiple tiers crowds out the velocity analysis that would actually predict upgrade timing.

When Intercom consolidated their pricing from six plans to three, they saw an immediate seventeen percent increase in conversion rates. The reduction wasn't about lowering prices—it was about reducing decision paralysis. Fewer tiers meant customers could focus on the right selection criteria rather than getting lost in feature comparison matrices. For CRM buyers, this lesson translates directly: tier complexity obscures the velocity question because it overwhelms buyers with position questions.

Zendesk's experience with a five-tier structure revealed the operational cost of tier complexity: forty percent higher support ticket volume related to pricing questions, twenty-five percent longer sales cycles for deals involving pricing discussions, and thirty percent higher rates of post-purchase plan switching. Each of these metrics signals that customers were selecting tiers based on incomplete understanding, then discovering mismatches between their actual usage patterns and tier constraints.

The post-purchase plan switching rate is particularly revealing. When thirty percent of customers change tiers within sixty days of initial purchase, it indicates that tier selection was based on faulty assumptions about usage patterns or growth trajectories. These early switches represent failed velocity predictions—customers thought they understood how quickly they'd grow into or out of a tier, then discovered their actual usage velocity didn't match their projection.

## Building a Velocity-Based Tier Selection Framework

Shifting from position-based to velocity-based tier selection requires measuring growth rates across each tier constraint dimension, then projecting when each limit will be reached. This framework doesn't eliminate uncertainty—growth rates fluctuate, business conditions change, and usage patterns evolve—but it transforms tier selection from "what fits today?" to "what fits our trajectory?"

Start by inventorying every constraint dimension in each tier under consideration. Beyond the obvious user seat limits, catalog contact record caps, storage quotas, workflow automation limits, API call allowances, email send volumes, custom field counts, and report generation constraints. Many of these limits aren't prominently displayed in tier comparison charts; they're buried in documentation or revealed only when you hit them. Requesting detailed limit specifications from vendors during evaluation surfaces these hidden constraints before they become operational surprises.

For each constraint dimension, calculate current usage and historical growth rate. If your contact database has grown from two thousand to three thousand records over the past six months, that's a fifty percent growth rate, or eight percent monthly. If workflow count increased from fifteen to twenty-two over the same period, that's forty-seven percent growth, or six point five percent monthly. These historical velocities provide baseline projections for future growth, though they should be adjusted for known business changes (new product launches, market expansions, seasonal patterns).

Project time-to-ceiling for each constraint by dividing available headroom by monthly growth rate. If a tier's contact limit is ten thousand and you currently have three thousand contacts growing at eight percent monthly, you'll hit the limit in approximately fifteen months. If the workflow limit is fifty and you have twenty-two workflows growing at six point five percent monthly, you'll hit that limit in approximately thirteen months. The binding constraint—workflows, in this case—determines your effective tier lifespan.

Compare this projected tier lifespan against your planning horizon and budget cycle. If your organization operates on annual budget cycles and the binding constraint will be reached in thirteen months, you're likely to face a mid-cycle upgrade with all its associated friction. If your planning horizon is three years and the binding constraint arrives in thirteen months, you'll experience two unplanned upgrades within your planning window. This projection reveals whether a tier that appears cost-effective based on current pricing will actually deliver value across your intended usage period.

Calculate the total cost of ownership across scenarios: starting at the lower tier and upgrading when constraints are hit versus starting at the higher tier from day one. Include not just the per-seat pricing difference but also the administrative overhead of mid-cycle upgrades (fifteen to twenty hours at seventy-five dollars per hour), training costs for new features (estimated at one hundred dollars per user for tier-specific capabilities), workflow reconfiguration time (five to ten hours of technical work), and opportunity cost during transition windows (estimated revenue impact of operational stalls).

For many organizations, this calculation reveals that starting at a higher tier—despite the higher monthly cost—delivers lower total cost of ownership because it eliminates mid-cycle upgrade friction. A tier that costs an additional five hundred dollars monthly but avoids a twelve-day operational stall worth seven hundred fifty thousand dollars in lost revenue is obviously the better choice, yet position-based tier selection would choose the lower tier because it focuses on monthly cost rather than velocity-adjusted total cost.

## When to Choose Higher Tiers Upfront Versus Planning for Upgrades

Velocity-based tier selection doesn't always recommend starting at the highest tier. Some organizations have predictable, linear growth patterns where mid-cycle upgrades are manageable and cost-effective. Others have uncertain growth trajectories where paying for unused capacity in a higher tier represents poor capital allocation. The framework's value is in making these tradeoffs explicit rather than defaulting to "what fits today?"

Choose a higher tier upfront when growth velocity is high across multiple constraint dimensions. If you're projecting thirty percent annual contact growth, twenty-five percent workflow expansion, and forty percent storage accumulation, you'll hit multiple constraints within twelve to eighteen months. The compounding friction of multiple near-term upgrades justifies paying for headroom even if current usage is low.

Choose a higher tier upfront when mid-cycle upgrades carry high operational cost. Organizations with strict budget cycles, complex procurement processes, or low tolerance for operational disruption should bias toward tiers with longer effective lifespans. The administrative overhead and opportunity cost of upgrades outweigh the monthly savings of starting at a lower tier.

Choose a higher tier upfront when the tier includes features that will be needed within the planning horizon, even if they're not needed immediately. If your roadmap includes territory management in year two and that feature is only available in the Enterprise tier, starting at Enterprise from day one eliminates a future upgrade and allows you to design processes around those capabilities from the beginning rather than retrofitting them later.

Plan for mid-cycle upgrades when growth velocity is uncertain or highly variable. Startups in product-market fit phase, organizations entering new markets, or teams piloting CRM for the first time may not have reliable historical data to project growth rates. Starting at a lower tier with explicit plans to upgrade as usage patterns clarify is a reasonable hedging strategy, provided the organization budgets for upgrade costs and builds operational flexibility to handle tier transitions.

Plan for mid-cycle upgrades when the cost differential between tiers is large relative to current usage. If the higher tier costs three times the lower tier but your projected usage won't justify those features for two years, paying for unused capacity may not be cost-effective even accounting for upgrade friction. This calculation depends on your cost of capital and opportunity cost of deploying those funds elsewhere.

Plan for mid-cycle upgrades when tier limits align with natural business milestones. If a tier's user limit matches your planned team size at the end of year one, and the next tier aligns with your year-two target, the upgrades coincide with budget cycles and strategic planning windows rather than arriving as surprises mid-year.

## Measuring Velocity Against Tier Limits in Practice

The velocity framework is conceptually straightforward but operationally challenging because most organizations don't systematically track the usage metrics that feed velocity calculations. CRM platforms provide dashboards showing current user count, contact records, and storage usage, but they rarely surface growth rates or project time-to-ceiling. Building this visibility requires either custom reporting or manual tracking.

Establish quarterly velocity reviews where you measure current usage across all tier constraint dimensions, calculate growth rates over the past quarter and past year, and project time-to-ceiling for each constraint. This review should be owned by whoever manages the CRM platform—typically a sales operations, revenue operations, or IT role—and shared with finance and executive stakeholders who control budget allocation.

The quarterly cadence provides early warning when velocity accelerates unexpectedly. If contact growth averaged eight percent monthly over the past year but spiked to fifteen percent this quarter due to a successful marketing campaign, that acceleration moves your time-to-ceiling from fifteen months to eight months. Detecting this shift quarterly rather than discovering it when you hit the limit creates a six-month planning window to budget for an upgrade or optimize usage to extend tier lifespan.

Track not just aggregate velocity but velocity by business unit or use case. A company with separate sales and support teams using the same CRM might find that sales contact growth is linear and predictable while support ticket volume (if stored as contacts or custom objects) is exponential and volatile. Aggregate velocity masks this dimensional mismatch, leading to tier selections that optimize for the wrong constraint. Disaggregated tracking reveals which business functions are driving velocity and allows targeted interventions—perhaps support tickets should be archived more aggressively, or perhaps support should use a separate system rather than consuming CRM tier capacity.

Build velocity projections into annual planning and budget cycles. When finance asks "what's our CRM cost for next year?", the answer shouldn't be "same as this year" or "twenty percent more because we're growing." It should be "based on current velocity across contact, workflow, and storage dimensions, we'll hit our tier ceiling in month seven of next year, requiring an upgrade that increases per-seat cost from forty to seventy-five dollars and adds approximately fifteen thousand dollars in transition costs." This specificity transforms CRM tier management from reactive firefighting to proactive capacity planning.

## The Strategic Implications of Tier Ceiling Visibility

Organizations that build velocity-based tier selection capabilities gain strategic advantages beyond avoiding surprise upgrade costs. They can negotiate more effectively with CRM vendors because they understand their own usage trajectories and can structure contracts around projected rather than current needs. They can make build-versus-buy decisions more accurately because they understand the total cost of ownership across their planning horizon, not just initial implementation costs. They can align CRM tier selection with business strategy because they're measuring growth velocity—a strategic metric—rather than just current position.

When evaluating CRM platforms, velocity-aware buyers ask different questions. Instead of "what's your per-seat price?" they ask "what's your tier structure and how do limits scale?" Instead of "do you offer workflow automation?" they ask "what are the execution limits and how are they enforced?" Instead of "what's included in your Professional tier?" they ask "what's the typical time-to-ceiling for companies with our growth profile?"

These questions signal to vendors that the buyer understands tier economics and won't be surprised by constraints. Vendors respond by providing more detailed limit specifications, sharing usage data from similar customers, and sometimes offering custom tier structures that better match the buyer's velocity profile. The negotiation shifts from "what's your best price?" to "how do we structure a tier that aligns with our growth trajectory?"

For organizations already operating a CRM, velocity visibility enables proactive optimization. If quarterly reviews show that workflow velocity is accelerating toward a tier ceiling while contact growth is slowing, the team can audit workflows to identify and eliminate unused automations, consolidate redundant processes, or refactor complex workflows to reduce execution count. These optimizations extend tier lifespan and defer upgrade costs, but they're only possible when velocity is measured and monitored.

The broader lesson extends beyond CRM to any software with tiered pricing based on usage constraints. SaaS platforms increasingly use consumption-based pricing where tier limits are tied to transaction volumes, data processing, API calls, or user actions. In every case, tier selection based on current position without velocity analysis leads to the same failure pattern: surprise upgrades, unplanned costs, and operational friction. Organizations that build velocity measurement capabilities for CRM can apply the same framework to marketing automation, customer support platforms, data warehouses, and analytics tools.

Understanding [how CRM systems are structured and deployed](https://flowccrm.com/articles/what-is-crm-software) provides the foundation for evaluating tier constraints, but velocity-based selection transforms that understanding into predictive capacity planning. The tier that fits your current needs is rarely the tier that fits your trajectory, and the cost of discovering that mismatch mid-cycle far exceeds the cost of measuring velocity upfront.

---

**About the Author**: This analysis is based on research across enterprise software procurement patterns, SaaS pricing optimization studies, and CRM implementation case studies. The velocity framework presented here synthesizes best practices from revenue operations, financial planning, and software vendor management disciplines.